The new Department of Defense Dependent Care Flexible Spending Account (DCFSA) for uniformed service members could be a great benefit for you to pay for childcare. However, there are several pieces of your financial life that you need to consider carefully.

I’ve labored over trying to reduce this program to useful rules of thumb, but there really isn’t any such thing. There are many individual variables that you need to walk through to make this decision for your family.

The best analogy I can come up with for how the DCFSA works is to think of it as your very own “off-shore” bank account. You know, like the accounts that big companies and shady rich people use to hide their profits. You’re depositing the money in an account “off-shore” (your DCFSA) and the IRS totally ignores the fact you made that money – as long as you use it for qualified dependent care costs. In other words, it’s a legal loophole of sorts (the IRS would probably hate me calling it that though).

Get Help to Look at Your Particular Situation

I’m going to say this up front, no matter how confident you are, utilize the resources available to you and schedule an appointment with a personal financial counselor on base and consult a tax professional to double check your work. You can use a free MilTax consultant as well.

I’m going to cover a lot, but I don’t know your specific situation and therefore can’t even begin to give you specific guidance. There’s just way too many variables you have to go over. However, don’t be afraid or get analysis paralysis though. Just schedule some time and get some help. You could be saving yourself hundreds of dollars or more just by knowing and efficiently utilizing your benefits.

DCFSA Key Facts and Variables

Here’s the main facts and variables you need to be aware of:

- Must have care expenses (daycare, elder care, etc.) for a qualifying dependent (example: child under age 13).

- Must have earned income (benefit limited to spouse’s earned income if married).

- If married, spouse must have earned income, be a student, or actively seeking employment.

- Must enroll during Federal Benefits Open Enrollment Season (13 November – 11 December for 2023) or after a qualifying life event.

- Saves you money on taxes by reducing your gross, and therefore, taxable income.

- Allowed to contribute as little as $100 to $5,000 per household, per year (other limits apply).

Overall, the DCFSA is a useful program that is new for the 2024 tax year for most uniformed service members. This benefit is limited to service members on active duty only. Unless you’re ACTIVE GUARD RESERVE on Title 10 orders, Reservists, National Guard, and Coast Guard are not eligible this year, sorry! This program/benefit is not special to the Department of Defense. It’s a federal program and is governed by the Internal Revenue Service (IRS).

The office responsible for implementing the DCFSA for federal employees is the Federal Flexible Spending Account Program (FSAFEDS). I do want to point out that the Dependent Care Flexible Spending Account is a different program than a “normal” Flexible Spending Account (FSA) for healthcare.

Benefit Limits for the DCFSA

The total amount of money you can put into the DCFSA per household is $5,000 per year. However, this is potentially reduced if your spouse doesn’t have enough income or if you receive other subsidies. For instance, if your spouse only made $3,000 this year, your total you can contribute to the DCFSA is $3,000.

What if My Spouse is in School?

Similarly, your total benefits you can use for the DCFSA may be reduced if your spouse is in school. Your spouse’s “earned income” is considered to be $250/month (one dependent) or $500/month (two or more dependents) for each month they’re in school. So, if your spouse was in school for six months and you have two children in daycare, the DCFSA limit would be set at $3,000.

Thinking back, this would have been a big help when we were sending my wife back to school and paying for childcare for my son. Although the threshold for the benefit would have been limited to $3,000 ($250/month x 12 months), it would have saved us roughly $600 in taxes that year. Keep in mind, the “earned income” assumption for a spouse in school is only for the months they’re actually in school.

What’s the Big Deal?

Basically, you put money into the DCFSA from your paycheck and this basically tells the IRS, “I never received this money.” I’m imagining slowly waving my hands in front of Uncle Sam’s face right now and saying, “You saw nothing…” So therefore, the IRS doesn’t count the amount you set aside in the DCFSA.

Then, as long as you use the money in the DCFSA for a qualifying dependent care expense, everything is good to go. You never pay taxes on any of the money from the DCFSA. So, if your total highest tax rate (because we’re reducing from the top marginal tax bracket) is 30% or more (22% federal, 5% state, and FICA of 7.65% would be 34.65% total) you could save $1,732.50 per year in taxes. Pretty sweet!

Still Eligible for Other Credits and Benefits

Another great thing about the DCFSA is it’s not going to prevent you from using other forms of assistance. You can still use the new Basic Needs Allowance (BNA), assuming you meet all other criteria. It also reduces your Adjusted Gross Income (AGI) (used to determine how much income tax you owe) which informs eligibility other benefits such as your daycare rates on post, Supplemental Nutrition Assistance Program (SNAP), and other benefits.

What’s the Catch?

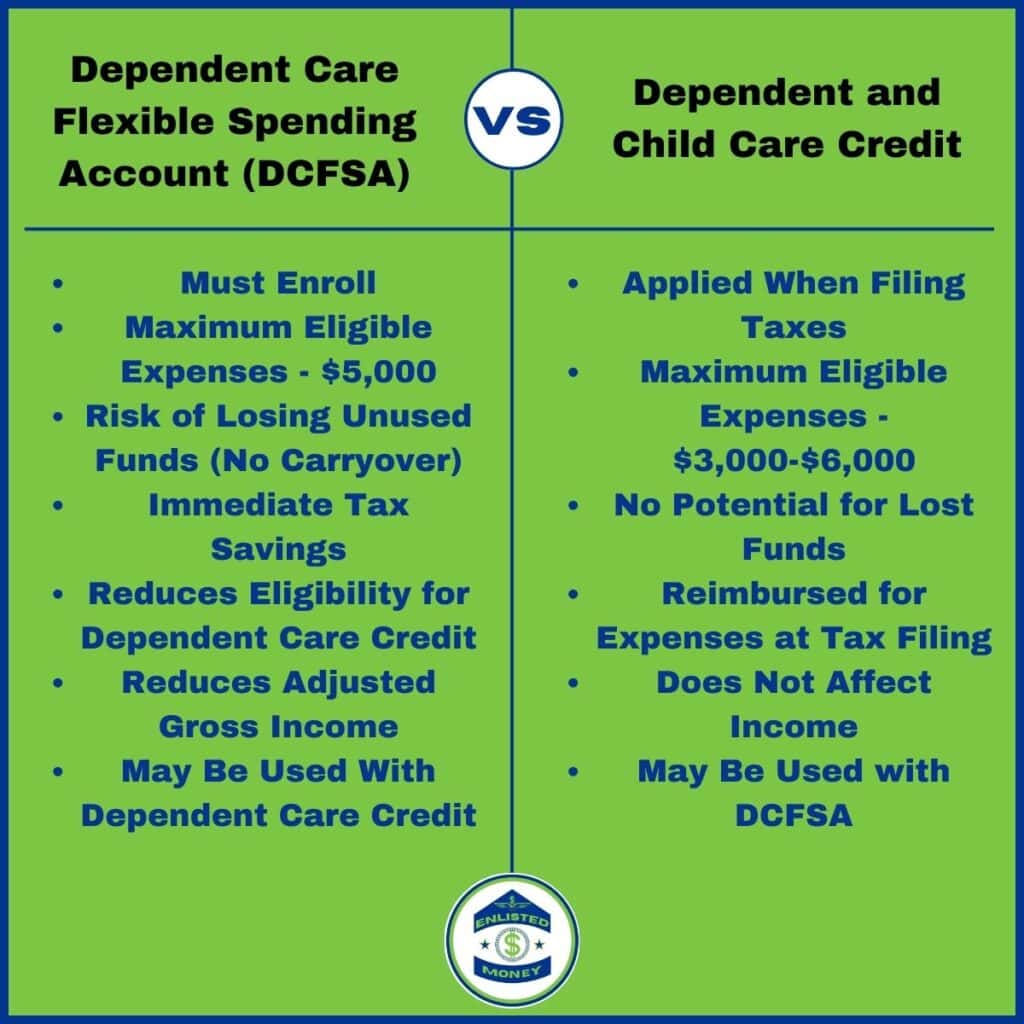

Well, there’s not technically a catch per se, but you do have a slight bit of risk – if you don’t plan properly. If you contribute too much to the DCFSA, and don’t use it by March 15th of the following year, you will forfeit those funds. So, you definitely don’t want to over contribute!

Although it might seem like the DCFSA is a great deal (and it is), it does affect your available “regular” Child and Dependent Care Credit you can use. In other words, you can’t use both benefits for the same dependent care expenses. However, you can still use both benefits if you have enough qualifying expenses.

Another Caveat for Dependent Care Expenses – No Double or Triple Dipping

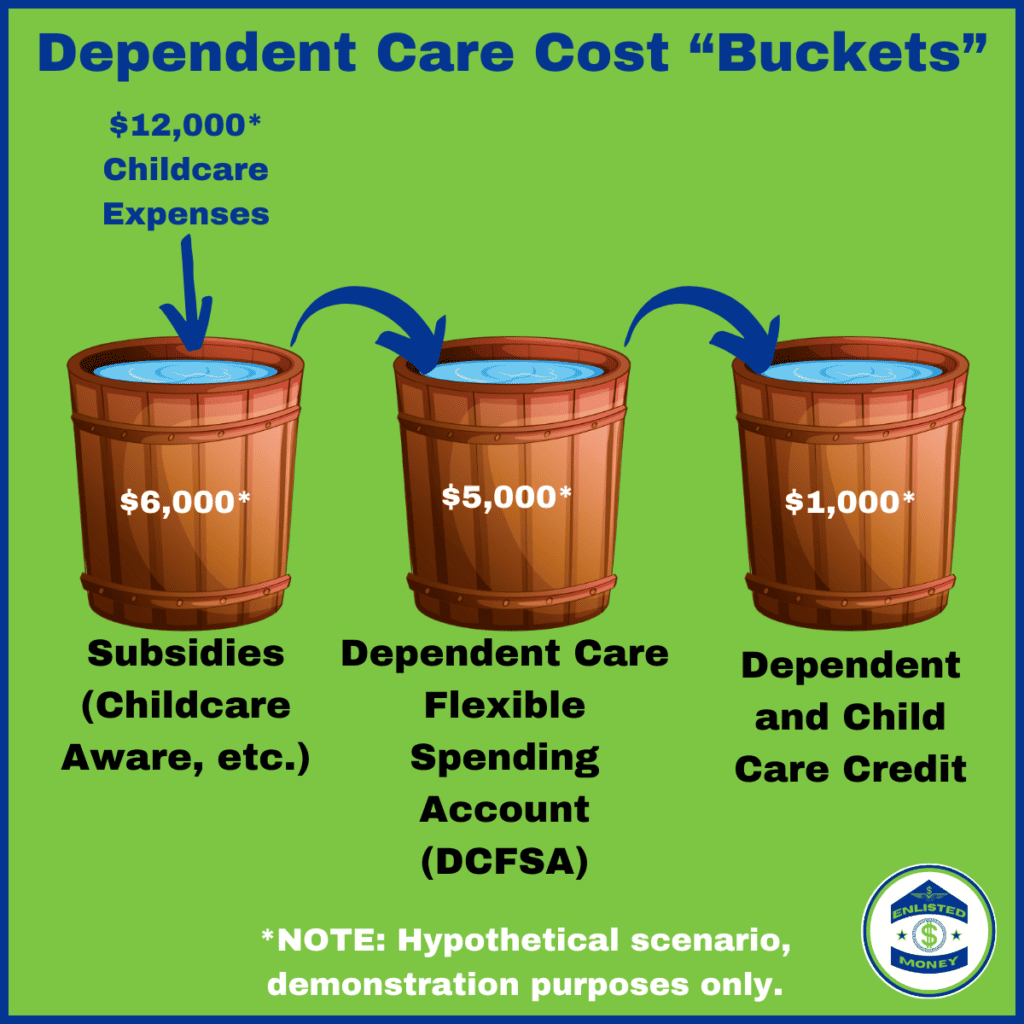

If you get a subsidy through a program like Childcare Aware, you cannot claim those expenses for the DCFSA or the Child and Dependent Care Credit. In other words, you can’t double dip into any of these benefit “buckets.” However, you can use a combination of all three if you need to.

So if your total childcare expense are $12,000 for the year, but you got $6,000 paid for through Childcare Aware, you can only claim a total of $6,000 of childcare expenses for the year. You WOULD NOT be able to use $5,000 of expenses toward the DCFSA and then try to claim an additional $6,000 of expenses for the Child and Dependent Care Credit.

Just think about all these as different “buckets” you can place your qualifying dependent care expenses into. In this scenario, assuming you are eligible for each “bucket,” you’d reduce your total costs to $6,000, claim up to $5,000 for the DCFSA, and then still be eligible for $1,000 toward the child and dependent care credit.

How Much Can I Save Using the DCFSA?

To keep this simple, I’m only going to assume all expenses are qualifying expenses from here on out.

Therefore, you need to consider if you would be better off using Child and Dependent Care Credit instead of the DCFSA or if you should only use part of your DCFSA benefits. The best way I can wrap my head around this is to convert everything into dollars. The Child and Dependent Care Credit is actually the easier of the two benefits to convert to dollars, so I would suggest you start there.

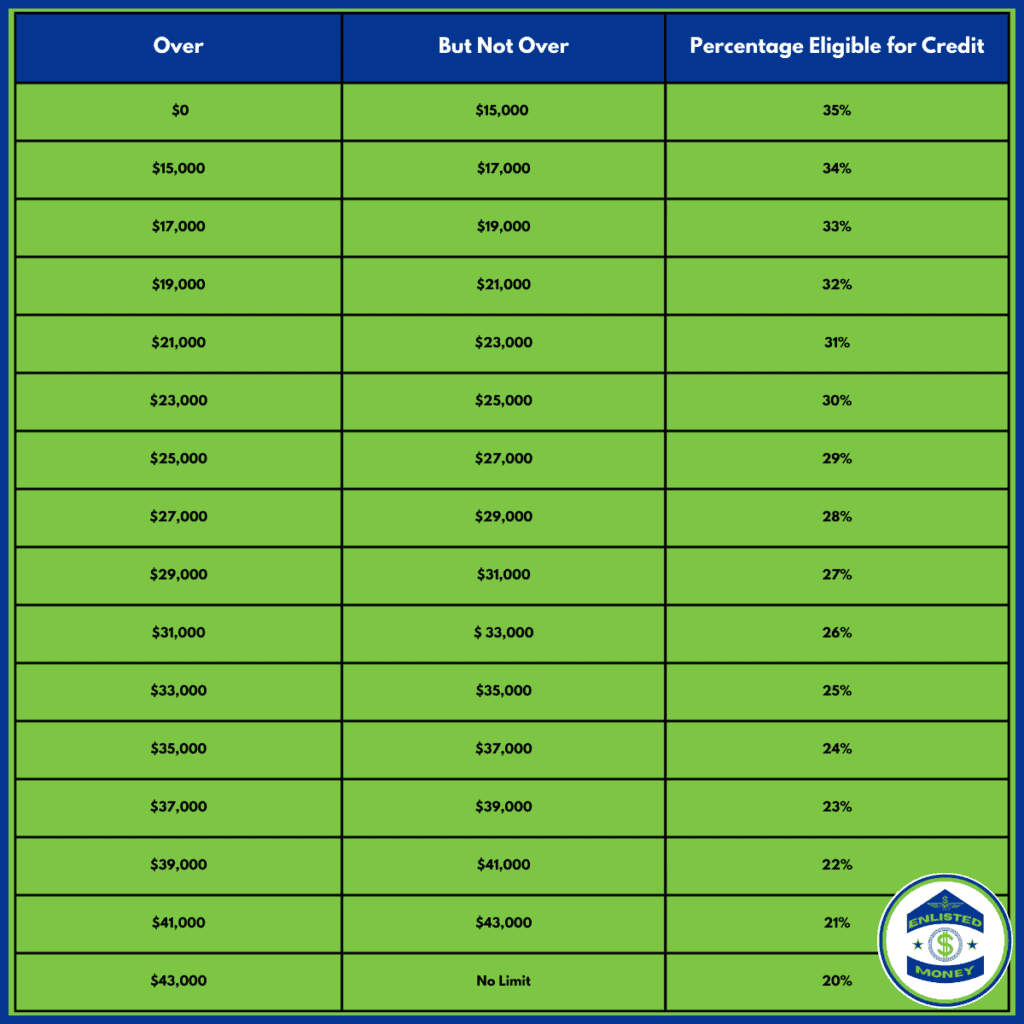

Calculating the Child and Dependent Care Credit

To calculate your Child and Dependent Care Credit, you need to calculate your total eligible dependent care costs. Then you need to see where your adjusted gross income (after deductions) falls within the thresholds for the percentage of credit allowed. Keep in mind, if you’re married, this includes your spouse’s income as well. Here’s a table of the thresholds from IRS Publication 503.

Calculating Your DCFSA Savings

To convert your DCFSA savings to a dollar amount, you have to consider all forms of income taxes. The money you put into the DCFSA is excluded from your income and isn’t subject to federal income taxes, state income taxes, or FICA (Social Security and Medicare) taxes. So you need to figure out your highest marginal federal tax rate, highest state tax rate, and also factor in your FICA which will be 7.65% of your income (15.3% for self-employed).

Using the same example as before, your highest federal income tax rate would be 12%. You will have varying degrees of state income taxation. For instance, my home of record (Missouri), doesn’t tax my income at all. Here’s a list of states that don’t tax some or all of your income. Let’s assume that you do have state taxes of 5% just for fun. Finally, add the FICA tax rate to make your DCFSA “multiplier” so to speak. It would look like this.

12% Federal Income Tax Rate + 5% State Tax Rate + 7.65% FICA = 24.65% DCFSA Multiplier

In decimal form (to punch into a calculator), it would look like this: 0.22 + 0.05 + 0.0765 = 0.2465

Now, you’ll multiply by your total eligible expenses up to your threshold. So, if you had the same $6,000 of expenses, you’d only be eligible for up to $5,000 of benefit for the DCFSA. You’d take $5,000 and multiply that by your “DCFSA multiplier” and get your total dollar amount of savings. It would look like this.

$5,000 X 0.2465 = $1232.50

But Wait, There’s more!

Don’t forget, in this scenario, you can still use the Child and Dependent Care Credit. Therefore, your remaining $1,000 of expenses could still be claimed at tax time for an additional $220 credit. This brings the total tax savings utilizing the DCFSA to $1,452.50.

Comparing the Benefits

Now that we’ve converted the benefits into something everyone can understand, dollars you’ll actually save, it’s much easier to see which one might be more beneficial to you. In our example for a married couple, using the DCFSA first and then claiming the Child and Dependent Care Credit is the winner. However, this isn’t going to be the same for everyone’s situation.

If your total childcare expenses are lower than the thresholds, you have different state income tax rates, your spouse is self-employed, or any other situation which affects your taxes (literally everything), it could affect how much of a benefit the DCFSA will be over the normal childcare credit.

If it ends up that you have low childcare expenses, your spouse has a low income (less than the thresholds), this could change things too.

When the DCFSA benefits and child and dependent care credit are close and you can’t claim both due to low expenses or low spousal earned income, you might need to decide if it’s worth the hassle. There’s a bit of work on your part for the DCFSA to set up the account, deducting from your pay, and then paying the provider and/or submitting for reimbursement.

For Single Filers, Divorced Service Members, Dual Military, and Single Children

One main difference is going to be your total exclusion amounts and tax rates. Also, you’ll have to be very careful with using the DCFSA if you’re divorced. This is NOT my area of expertise, so definitely get with your attorney, tax professional, or financial planner (probably all three) to run through all this. The DCFSA is by household, so the limit is still $5,000, but you need to make sure you’re eligible to claim your child as a tax dependent.

For single filers, you’d follow similar steps, but your income tax rates will be different.

Also, the DCFSA has a higher limit if you only have one child ($5,000 vs $3,000 for single dependent for the child care credit). So, if you only have one dependent with expenses, the DCFSA would allow you to claim $2,000 more in expenses. And keep in mind, you can still use both.

For dual military couples, it’s important to note that the DCFSA is per household. There will be many other variables to consider as well.

Resources to Help with the DCFSA

Luckily, there are a lot of great resources for the DCFSA. I’ve linked to some or all of these throughout the article. Also, if you enjoy podcasts, you can listen to me talk about it here. There’s also another episode on The Military Money Show and the Military OneSource Podcast both have episodes covering the DCFSA. I thought I’d consolidate all the links I could to make it easier for you to reference later.

FSAFEDS Comparison Worksheet

FINRED (usalearning.gov)

Executive Order on Advancing Economic Security for Military and Veteran Spouses, Military Caregivers, and Survivors | The White House

New Benefit Gives Military Families More Flexibility in Paying for Dependent Care > U.S. Department of Defense > Release

PUBL263.PS (congress.gov)

Make Sure to Reach Out with Questions

Like I said in the beginning, this is a very complex, yet useful benefit. It is very specific to each service member’s particular situation. Key variables like your income for next year, total childcare expense, state tax rates, number of dependents, and more come into play. I highly recommend that you get in touch with a financial professional to get help with this.

Final Thoughts

Overall, the people who will benefit the most from the DCFSA are those who have higher incomes and higher childcare costs. That doesn’t mean that someone with lower income couldn’t benefit, you probably will still benefit. I can think of several times this benefit would have been handy for us at a lower income level. Regardless, if you have dependents who have costs associated with caring for/supervising them so you can go to work, you should look into the DCFSA. Don’t put it off either! If you miss the open enrollment, you can’t use the program unless there’s a “qualifying event” like a birth, change of station (PCS), etc. I hope this helps you think through this new-to-us benefit.

Thanks, Mike Hunsberger!

I wanted to say thank you to Mike Hunsberger, ChFC®, CFP®, CCFC, Founder and Lead Advisor at Next Mission Financial Planning, for reviewing this article and giving me feedback to make it even better!

This is an outstanding article! I wish I’d know about this when I was enlisted; many of my shipmates were struggling with childcare costs. This could have eased their burden a bit.

Thanks Brandon!

Thanks! I’m glad you found it helpful! The DCFSA is new for us this year, but the subsidies and tax credit isn’t. Thanks for reading!