With market returns, your money will double every ten years on average. This means that at retirement, an investor who started 10 years ago will have twice the money of someone of the same age who starts today. How is this possible? Compound interest.

The S&P 500 has an annual inflation-adjusted return of about 7%. Using the rule of 72 means your money would double about every ten years. So, if you wait ten years, you miss out on one more chance to double your money. This is why it’s so important to start early. But how does this even work?

Compound Interest Defined

First, let’s define what compound interest is. When I say the word interest, I mean a return (money you make) on principal (money you invest). Merriam-Webster online defines compound interest as “interest computed on the sum of an original principal and accrued interest.” In other words, it’s the reward for investing.

When you reinvest the interest, your initial balance grows.

Then you have more money invested which earns more interest, which is reinvested too.

Now you have even more money invested, which earns even more interest, which is also reinvested. I think you get the point now.

Eventually, this effect keeps going, and going, and going. It’s like a machine, a money-making machine, that just goes faster and faster the more “fuel” you feed it. This is the effect of compounding interest. In the simplest terms, it’s when your money makes money.

Why Compound Interest Matters

Compound interest is crucial for building wealth because it decreases the amount of effort needed from you. If you didn’t invest your money, you would need to save up a whole lot more. Let’s walk through a short example.

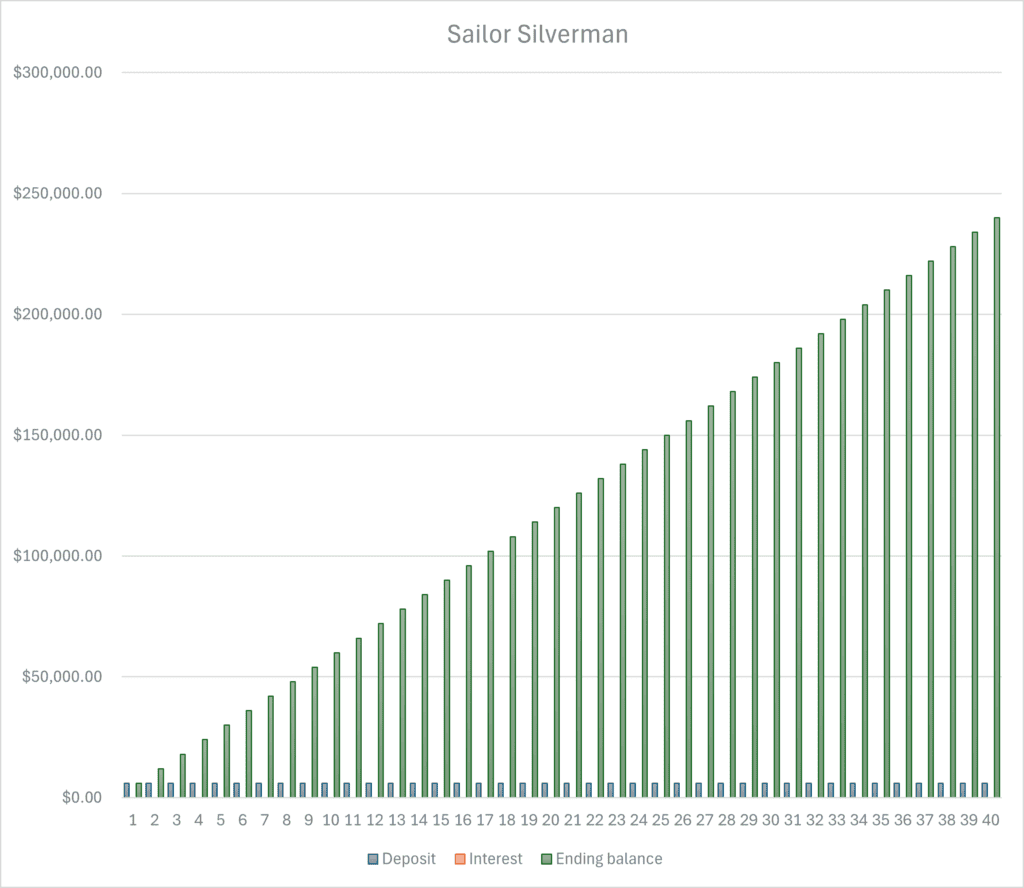

Sailor Silverman puts $6,000 a year ($500 per month) under his mattress every month. He knows he’s going to need money to retire, so he’s saving as much as he can. He doesn’t trust the stock market because his dad always said the stock market was a big gamble (because his dad put his life savings in penny stocks and lost it).

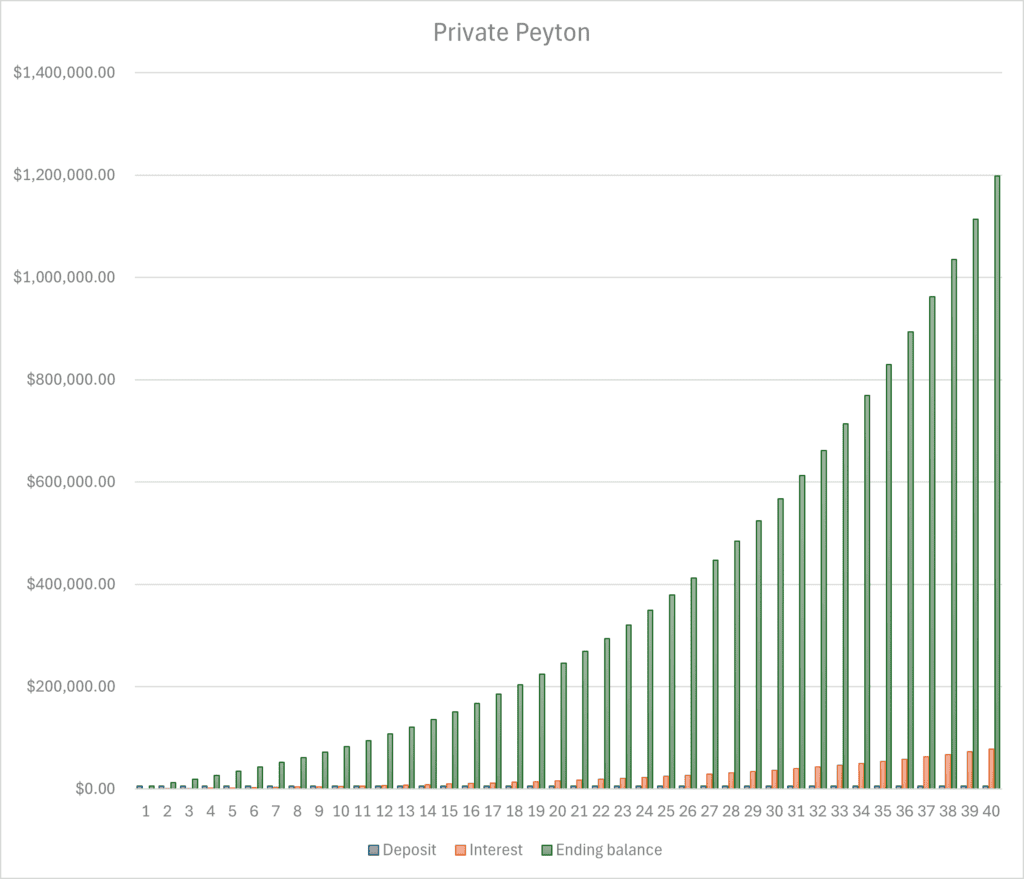

Private Peyton likes to travel. However, he knows he wants to save for his eventual retirement too. He puts away $6,000 a year ($500 per month) as well.

In 40 years, Sailor Silverman has done a fantastic job of saving a whopping $240,000. Great job! That’s nearly a quarter of a million dollars! What about Private Peyton?

Our pal Peyton has faithfully invested $500 per month. He’s seen his balance drop a few times, but he just kept putting money in. Peyton checked his balance at 40 years and smiled great big when he saw not one, but two commas on his balance of $1,197,810! He’d hypothetically have more than $2.4 Million if we didn’t adjust for inflation.

Here’s what the two charts look like:

As you can see, Private Peyton’s interest keeps growing and creates a curved line moving up. Without investment earnings, you’ll have a much harder time. Even if Sailor Silverman used a government bond or something to earn a little interest, he’d still probably just keep up with inflation.

***Note: Technically, you’d have even more money because you’ll be investing monthly. For simplicity’s sake, these examples and charts were calculated on an annual basis with each deposit at the end of the year. If you calculate Private Peyton’s savings using monthly deposits and annual compounding, he’d have $1,235,771.

The Power of Time

How long you’re investing affects the growth of your investments significantly. Even just waiting 5 years to start investing would have cost Private Peyton over $368,389! Ouch! He’d “only” have $829,421 after 35 years.

On the other hand, an extra five years of compounding growth would give him an extra $516,685, for a total balance of $1,714,495. That’s a difference of over half a million dollars!

You really can’t afford to put this off. It’ll never be easier than today. Don’t wait!

And if that’s all invested in a Roth account, that’s tax-free money! This is really powerful stuff. You really can’t ignore the power of time.

The Role of Interest Rates

One thing always comes up when we’re talking about investing—the interest rate. How do different interest rates affect the growth of investments? Well, they do have a significant effect. However, I want to emphasize two points on this: you can’t control the market return you get, you can control your savings habits.

It’s true that a higher interest rate or growth rate will yield significantly better results over time. This also has a compound effect. However, you are not likely to beat the market. In fact, most people who manage money for a living can’t even beat the market (S&P 500). What are the chances you can beat the market if they can’t beat the market? Probably about zero.

Focus on What You Can Control

You may not be able to beat the market, but you don’t have to. There are a few other things you can do to be a successful Envestor (enlisted + investor = Envestor). I urge you to focus on increasing your savings rate, starting early, reducing fees, and being consistent.

We already talked about starting early. What about your savings rate? If you can slowly increase your savings rate over time, you can significantly increase your total savings.

Save More Later

I’ve used the “save more later” method to invest more over time. I stole this terminology from the book Nudge by Cass Sunstein and Richard Thaler. Here’s how it works.

You start investing as much as you afford to. Then every time you get a pay raise, you increase your savings. Over time, your savings rate will grow. This is actually really easy for service members to do.

If you set your TSP to at least 5% (or more) of your base pay (so you can get a match if you’re BRS), then you can just bump it up one or two percent with each pay raise. If you do this, you’ll never miss the money, increase your savings rate, and still get some reward for your hard work.

Beware of Fees

I’ll just say this about fees: Everyone has them, and they all stink. However, you want to pay as little in fees as you can. The TSP has some of the lowest fees out there. You can get lower fees with some of the other large, discount brokers on the market, such as Vanguard, Schwab, and Fidelity. There are others, but those are the most popular options.

If you can, just look for expense ratios of about 0.10% per year or less. If it’s under that, I wouldn’t give it a lot of extra thought when you’re getting started. Obviously, lower expenses are always better. There’s nothing wrong with the TSP though.

The Effect of Regular Contributions

Keeping up with regular contributions to investments is critical. I know it’s going to be tough at times, but you really want to invest consistently. If you fail to “feed the machine” regularly, it won’t be as effective.

Dollar-Cost Averaging

A nice side effect of making regular (monthly) contributions is dollar-cost averaging. This means you’ll be purchasing through market fluctuations. So, when the market is up, you’re going to buy at the “going rate” today. However, if the market has a drop like in a recession, you’ll be able to buy “at a discount” to what prices were.

This ensures that you’re always buying low. In theory, all the money you invest and leave for a long period of time will grow. It’s cheaper to buy today than it will be in 10, 20, or 30 years.

Growth of Compounding Over Time

If you’re still not convinced, I’d ask you to send me an email to let me know what still doesn’t make sense. There’s no guarantee of returns and they’ll be lumpy, but the evidence of history shows growth in the market over a long period of time. However, we can’t predict the future.

Also, if you want to play around with some tools to see how much you need to save for retirement or what your investments might do, you can check out my FI Number Calculator. You can also check out the investment calculator on Calculator.net. They have some really simple but useful calculators.

Another handy tool is New Retirement. I don’t have a relationship with the company, but their software is pretty easy to use. The basic version is free, but they have paid options they obviously want to sell you. Regardless, it can give you another pulse check.

Have Realistic Expectations

Make sure you’re setting realistic expectations for growth. I periodically check to see where I’m at, if market assumptions and inflation have changed, and if the cost of our goals has changed. I always err on the side of using a lower rate of return, increasing my savings for a buffer, or both.

Regardless, you need to be realistic with the numbers you’re using. Be cautious about others who tell you they can get you outsized returns. They probably can’t. And even if they did one year, that doesn’t mean they can the next year.

Conclusion

In its simplest form, compound interest is simply when the interest from your money makes you more money. If you can harness it, compounding growth can help you reach your investment goals much faster.

I hope you’ll start investing and take advantage of compound interest, if you haven’t already. If you don’t know where to start, be sure to check out my free resources – including my free Get Started Checklist™ as a starting point.