One of the most common questions I get asked is how much you should be saving for retirement. Once people start thinking about their finances and understand they should be saving for retirement, the next logical question is how much.

It’s actually really hard to predict exactly how much you’ll need in 20, 30, or possibly even 50 years from now. However, we can use our spending now to estimate spending later. Don’t worry, I’m going to try to keep the math as simple as possible.

Actually, I made a calculator, but first, I want you to understand the process behind it. Also, the numbers you’ll get may seem a little overwhelming at first. Don’t panic! This is just a guideline and things can be adjusted along the way.

Disclaimer: It’s also VERY important to understand that all these calculations are ASSUMPTIONS. Nobody knows what the stock market will do, what inflation will be, or anything else in the future. We are just making BEST GUESSES on these numbers. You can, and should, revisit this from time to time (like maybe during Money Day each year).

The Inputs You Need

The biggest things you need to get started are your annual expenses, current savings, and when you want to retire. The rest, we’ll use assumptions based on historical averages. This includes the inflation rate and the historical market returns.

Inflation Adjustments and Assumptions

In order to understand how much money you need to save for retirement you need to figure out what today’s spending will be 20 to 50 years from now. In other words, we need to adjust for inflation. We want to make sure we’re adjusting for inflation as we go, but not adding it in too many times either. To do this, I used the historical inflation rates and then calculated an average inflation rate. As of this writing, the historical average inflation since 1913 works out to 3.16% on average. This is the assumption I’ll be using throughout this article.

Market Returns

I’ll be using the S&P 500 as the “market return” assumption. If you look at returns since inception, the annualized rate of return is 9.90%. Keep in mind, this is NOT adjusted for inflation. After being adjusted for inflation, it’s right around 7%. We’ll adjust for inflation when we calculate your future expenses, so we won’t use the inflation-adjusted return numbers. More on this later.

Understanding Your Expenses

If you don’t know exactly how much you spend, you have no idea how much you’ll need to sustain your current lifestyle. If you don’t know, you need to do some basic budgeting first. You can download my free budget template if you need something to get you started.

Once you know your monthly expenses, you can multiply that by 12 to get your annual expenses. Now, keep in mind, your expenses will be different if you get married, have kids, move to a different area, etc. I have always calculated our FI (Financial Independence) number based on the highest cost of living area we’ve lived in. If I end up somewhere cheaper, that just makes life easier.

Regardless, your FI number is generally 25 times your expenses. This is based off the “4% rule” which was originally created by Bill Bengen and also credited to the “The Trinity Study” to show safe withdrawal rates. Actually, the 4% withdrawal rate is pretty conservative and doesn’t include your ability to adjust your spending down if needed in bad times.

If you want to get even more nerdy with safe withdrawal rates (how much money you can spend without running out of money in retirement), check out some of these articles:

Safe Withdrawal Rate for Early Retirees

Fixing A Broken Retirement Withdrawal Plan

The Impact of Market Valuation on Safe Withdrawal Rates

Why High Equity Valuations And Low Bond Yields Won’t (Necessarily) Break The 4% Rule

However, just know, the 4% rule will get you to a very good spot and likely leave you with plenty of money to pass on to heirs – probably. Nothing is guaranteed because we can’t predict what markets will do. Moving on.

Three Main Calculations to Make

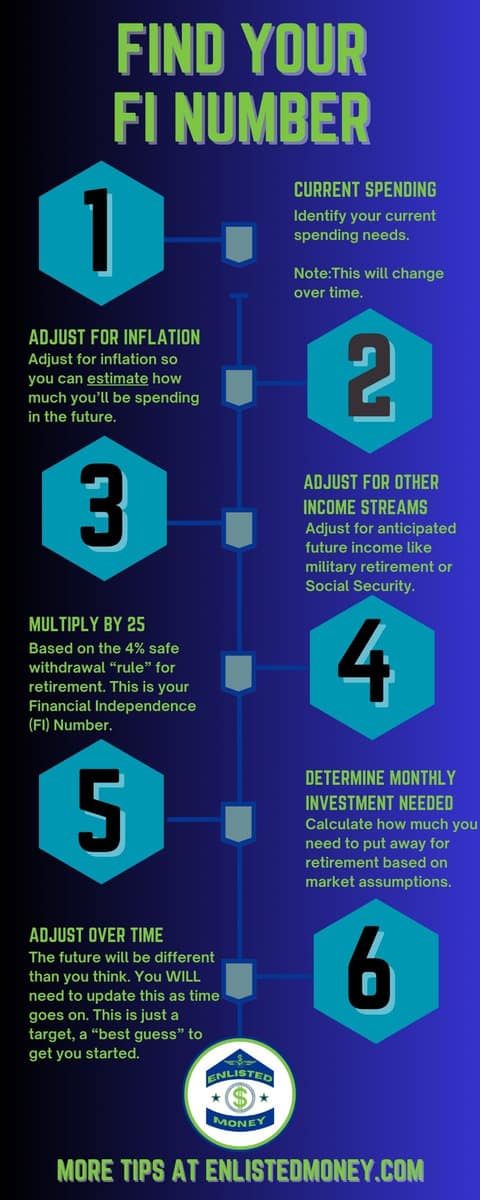

To figure out how much you need to save, you’ll need to make three main calculations: Future Value (FV) of current expenses (adjusted for inflation), your FI number (25 times expenses), and the estimated investments required to achieve that number (monthly investment goals).

Future Value of Expenses

Just take your current annual living expenses and make a future value calculation using inflation. This number may be a bit shocking at first, but this will just highlight how much inflation can mess with your plans.

The reason why I like to inflate it like this is because:

- This is what I was taught in my financial classes in college.

It makes more sense to me to work toward a real future dollar figure instead of using my income today and then adjusting my market return assumptions for inflation.

Calculating Your FI Number

Now take your estimated future annual expenses, multiply that by 25. This is your FI number.This is adjusting your savings goal to use the 4% withdrawal rate. In other words, if you have this amount, you can pull out 4% of your investment portfolio each year for the rest of your life.Once again, this number may seem insanely large – especially if you’re young. The good thing is if you’re young, you also have an insane amount of compounding growth over the next several decades to help you out.

Investments Needed to Reach Your FI Number

Now you can calculate how much you need to save based on how long you have to save and market returns. Once you get this calculated, you’ll know if you’re saving enough or not.You’ll want to include the money you’ve already saved in your TSP or Roth IRA. Make sure you factor this into your calculations. As you’ll see in the case study further down, it can make a significant difference.

I use my handy, dandy financial calculator for this, but you can use the calculator I made for you in Excel. It essentially uses the future value (FV) formula options to do this.The end result is that we have a monthly investment target. You should be able to say at the end of this step, “I need to save $___ per month for me to retire with [insert FI number] in [insert year you want to retire].”

You should revisit this once a year to make sure you’re still on track. Just like a land navigation course, it’s best to check your azimuth to make sure you’re still moving in the right direction.

That’s a Lot!

If this is way more than you can afford right now, I’d say a few things:

1. I challenge you to find wasted spending to redirect.

2. You can save more over time with future raises, side hustles, etc.

3. You may need to retire a couple years later.

At the end of the day, there’s only so much you can control. You can’t control inflation, market returns, or the passing of time. However, you can control how much you spend, increase your earning potential, and how much you save and invest.You also get to decide how expensive your lifestyle is. Choose wisely.

Coast FI Number

Another term you’ll hear a lot is someone’s “Coast FI” number. This is simply the amount of money you need to have invested today to reach your FI number at retirement – without adding anything else to your investments.

This can be found by completing a present value calculation of your FI number without any additional payments. This is a great short-term target. If you’re single and don’t have kids, I’d really try to hit this before then (I didn’t and we’ll be just fine). Make sure to readjust when your life becomes more complex and expensive (children are expensive).

Inflation Double (or Triple) Jeopardy

Adjusting too many times for inflation is a common mistake. It’s easy to think you need to adjust current expenses for inflation, then use an inflation-adjusted return assumption, and then assume you’ll need an extra 3% on top of the 4% withdrawal rate throughout retirement.It’s important to be concerned about inflation. It will happen over time. However, you don’t want to count it too many times.

The 4% “rule” for safe withdrawal rates already accounts for inflation. Also, we adjusted your living expenses for inflation already. Just ensure you’re accounting for inflation in your targeted FI number and plan to utilize the 4% rule as a guide in retirement. Then you don’t need to use the inflation adjusted return assumptions or adjust again for inflation in your retirement spending numbers.

However, if you did adjust for inflation an extra time (or two), you’ll just have that much more money in retirement. If you’re struggling to hit your targeted savings rate or making yourself miserable in the process, you might readjust things a bit.Bottom line, you don’t want to under save, but you don’t want to deprive yourself of living your life now either.

My FI Number is Huge! Can I Reduce It?

If you look at the numbers, it can be really intimidating. There are other income factors you may want to consider. If you’re early in your career, I wouldn’t bank on going all the way to retirement. You might, but statistics say no – actually you also have a much higher chance of being medically retired than making it to 20.

If you’re at 18 or 19 years in service, you can reasonably guess at your retirement earnings (links to calculators on my resources page). Also, if you want to have a couple cash flow positive rental properties, you can include that. You’ll also likely get something from Social Security too. If I was a betting man (I’m not), you’re highly likely to get something from Social Security. It just may be at a later age or at a reduced payout. Only time will tell.

Regardless, you can subtract these from your annual living expenses before multiplying by 25 to adjust your FI number. I’d only do this if you know for sure you’ll have those income sources in retirement. For instance, I don’t include my side hustle income because I’m not planning on doing side hustles at 65 or 70 years old.

A Recent Case Study

I recently got the chance to sit down with one of my coworkers and help calculate her FI number. We’ll call her Emily. Here’s the basic process.

We used her current salary as the starting point. I left this up to her, but she chose to use her current salary versus expenses. She’s not married and doesn’t have any kids yet. Needless to say, her expenses will likely be more overtime. For me, I’d use my current expenses since these have been fairly stable for several years.

We then inflated Emily’s current salary (expenses) to equal what she’d need at retirement to have the same standard of living. This is important because if you don’t account for inflation, you’re going to be really disappointed when your current budget doesn’t go nearly as far in retirement.

Then we multiplied her estimated living expenses at retirement by 25 to arrive at her FI number. This was a scary number for her at first. In fairness, I was a little nervous too. I didn’t want her to get overwhelmed. However, Emily’s young and has a long time to save money, so the numbers are a little more forgiving.

Finally, we calculated how much she’d need to save per month. Once I showed her that, she felt it was much more achievable. Then something else cool happened!

What About My Roth IRA?

Emily asked me, “Should we add in my Roth IRA as well?” She had started a Roth IRA this past year and has already accumulated around $3,800 (which is awesome!). Of course, I wanted to add this into the calculations to be as accurate as possible.

After adding in this extra Roth IRA balance, we projected she’d have an extra $145,000 in her account at retirement. Her response: “That kinda slays!” I’m still not 100% sure what that means, but she was very happy! I was too!

It really highlights how important it is to start early. If she’d waited even one more year, she’d lost out on a good bit of money. Also, this means she’ll actually need to save about 11% less money each month to reach her goals. Pretty “slay” if you ask me! (Did I take the “slay” thing too far?)

Regardless, it was really rewarding to get to help her chart a path to financial independence. I get so excited when people let me help them in this way. Because Emily’s starting early, she’ll be a multimillionaire with way less effort.

Is Your FI Number Really THAT Important?

At the end of the day, your FI number is a somewhat arbitrary target. You’ll need to update and adjust as time goes on. Your expenses will change, your wants will change, your LIFE will change over time. Don’t be afraid to save more (recommended) or less as things happen in your life (temporarily). Remember, this is your life, and you don’t have to live it like anyone else. When you’re first starting out, it’s best to save more than you think you need – you can always spend more later.

However, I do retirement withdrawal calculations for retirees in my work as a paraplanner. I can attest this 4% target won’t leave you disappointed. In many cases, people can (but typically don’t) pull out more than 4% per year.

Sound Complicate? Don’t Worry – I’ve Got a Calculator for That!

To help you out, I’ve created a FI Number Calculator to help you recalculate your FI number whenever you want. All I ask in return is that you join the Envestor Community (requires your email address) and let me know if there’s something I can improve on.I’ll also send out updates if I make changes to assumptions, add new features, etc.

Keep in mind, this calculator isn’t perfect and the assumptions in it are just that – assumptions. We all know what happens when you assume, right? Make sure to revisit for updates and understand that things will change. That’s just life. Remember to focus on what you can control.

Just Get Started!

Don’t wait to get started investing! It’s so much easier when you’re young!If you’re not young, don’t worry, the next best time to start is today! As a matter of fact, if you’re already “late to the party,” it’s even more important you take action right away.

If you don’t know where to start, check out my Get Started Checklist™, budget template, and net worth tracker on my resources page as well. I hope this was helpful!

A Big Thanks!

I want to give a huge thanks and a shout out to Rob Moore of Everman Prosperity Financial Planning and Erik Baskin of Baskin Financial Planning for reviewing this article and helping me refine the FI Number Calculator! Their feedback and Excel wizardry tips and tricks were so helpful in making this article. Thanks a ton!