Updated 29 March, 2024

It may seem a little extreme, but a simple phone conversation started what would eventually grow to $40,000 plus. All for $50/month.

The Phone Call that Started My Roth IRA

I can’t remember exactly why, but I called USAA while I was deployed to Iraq sometime in early 2007. I’m guessing; there was a lot going on in Iraq at the time… At the end of the call, the lady on the phone asked if I’d be interested in opening an IRA. WTF is that?

I had no clue what an IRA was, and still didn’t know what an IRA was until many years later. She explained I could start with $50 a month and my money would grow tax free until I needed it in retirement. At the time, I felt like I was making lots of money (tax-free combat pay, baby!).

I agreed to open a Roth IRA and was transferred to the investment department where they set me up with everything and helped me decide on investing everything into a mutual fund. Once again, I can’t remember, but I think it was called a “Cornerstone” fund?

At the end of the conversation, I committed to investing $50 a month into this fund.

A Note on Gullibility and Dumb Luck

Let’s pause for a second and point out a couple things. I was arguably very gullible and/or naive. I’d just committed $600/year to something I didn’t understand and invested in a fund inside the Roth IRA I also didn’t understand. As a matter of fact, it was probably another five years before I could explain to you exactly what a Roth IRA was.

This is often how service members get themselves into trouble – sometimes really big trouble. Many of us don’t understand everything we’re doing with our money, but don’t want to feel stupid by asking too many questions or missing out on something that could be good for us. Thinking back, have you ever done something like this?

Luckily, I didn’t piss my money away. This story actually turns out really good for me. I just want to point out the fact that I didn’t know if this was really a good or bad decision; I just went with it. Now, back to the story.

The “Maths” Start Compounding

I kept letting the money come out of my checking account every month automatically for the next several years. I would love to tell you that I knew the “maths” behind what I was doing and made a decision to keep putting money in there. Inertia.

Inertia is why I kept investing money into that Roth IRA. Nobody was asking me at the end of a phone call to change my address if I wanted to stop giving them money. I just never turned it off – at least not yet.

I Finally Educated Myself

Eventually, I did go back and look at my decision to open and keep funding my Roth IRA. If I remember correctly, I had just read the book A Simple Path to Wealth by JL Collins. This prompted me to look at my Roth IRA and ultimately make some changes.

If you’ve never read the Simple Path to Wealth, I do suggest you do. However, the main takeaway that I got from that book is this: invest in low-cost, broad-market index funds and let time do the rest. There’s obviously a whole lot more to the book, but the action item I got was, open a Roth IRA at Vanguard and invest it all in VTSAX. JL Collins suggests VTSAX in the book as a singular fund you can invest your money into.

I Took Action

So that’s pretty much exactly what I did. I opened an account at Vanguard and (eventually) transferred my Roth IRA from my USAA account to Vanguard. Why?

I looked at the fund I was invested in and saw that it wasn’t performing as well as VTSAX and the fees were higher than VTSAX. I didn’t need a third strike to make a move.

The Roth IRA Transfer Process

The process was somewhat tedious. I was living overseas at the time in Korea, so I didn’t have all the normal facilities available that I’m used to. USAA (and many other banks) require a special kind of notary called a Medallion Signature. I was pissed because I thought (and still kind of do) this was just a way to deter me from moving my money out of my account – I was even more determined to transfer the funds.

Ironically enough, the only place that I could get this Medallion Signature was at the Navy Federal on base. They said if I was a member, they would do the Medallion Signature for free. I took a $5 bill out of my wallet (the minimum to open an account) and became a Navy Federal member that day.

After that hassle of getting the medallion signature, everything else was pretty straight forward. I mailed all the paperwork off and after a week or two, the money arrived in my Vanguard account.

What Amazing Growth You Have

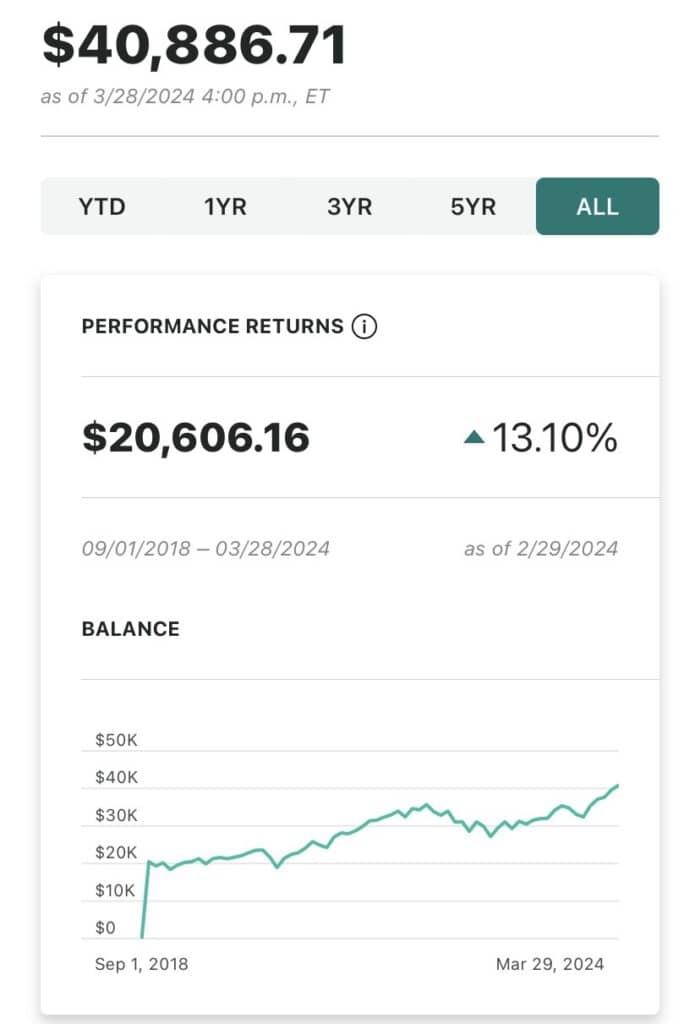

At the time of the transfer, there was a total of [insert drum roll here] $20,280.53!

I was honestly pretty shocked at how much was in there. It’s hard to believe I had $20k in my account from so little effort. I never noticed that $50 was “missing” each month. It had just grown slowly in the background for several years.

What’s even more interesting, I haven’t added a single penny to that Roth IRA since I transferred it and it’s grown an additional $10,195.48 to $30,476.01 today (even with the recent market issues). I literally made $10,195.48 just from growth alone.

Update: I’ve still done nothing to this account and it’s now grown an additional ten grand to a current value of $40,886.71. And no, this isn’t my only account. I primarily use my TSP currently because it’s simple, cheap, and easy to use. So, I made $10k in a year by literally doing nothing.

Happy Accident and the Power of Compounding

The power of getting started, automating, and being patient (even if it was due to neglecting to pay attention like me) is very powerful. If you’d told me in 2007 that I’d have over $20,000 in 11 years from only $50/month, I’m sure I would have laughed. I only wish I’d committed to increasing my contributions over time, but there’s no going back now.

However, I’m glad I got started. I’m thankful that a simple up-sell on a random phone call turned out to be a good thing. I’m really happy I get to share this story with you.

The main thing I want you to consider is starting, even in a small amount, is very powerful. You can do a lot of things wrong, but if you save and invest your money consistently over time, you’ll be really glad you did.

Start Today!

If you’re not putting anything away for retirement, start today. It doesn’t have to be in a Roth IRA. Actually, the reason I never added anything to my Roth IRA is because I decided to just use my TSP instead. It was easier to set up automatic deductions (which I’d already done by that point) than trying to figure out how to do that with Vanguard.

Now I continue to invest automatically every single month. I have changed what I’m invested in and how much I invest, but the same principles still apply. If you need help getting started, let me know how I can help. I’m trying to prevent others from having the same regrets I have.

Commit to start investing today. Good luck!

If you have a similar success story you’d like to share, please hit the button below and share it with me!