One of the things we’ve been preparing for is the loss of income when I retire from the Army. I wish I’d started this much sooner, but I feel really good about our progress and where we’re at currently.

I’d like to walk you through the financial “off-ramp” we’ve created and how we’re thinking about replacing my active duty pay. I feel this is one of the most critical pieces of the transition puzzle.

Understanding What My Retired Pay Will Be

First, we need to understand exactly what I’ll get paid from my pension. It’s a bit shocking (and saddening) to see how much “half” really is.

After decades of receiving extra pay like BAH and BAS, it’s a splash of cold water in the face to see what half of base pay is. But knowing what I’ll get is essential to starting to build a realistic plan.

The DoD retirement calculators are a great tool. Every year for Money Day, I run a new estimate and adjust our plan accordingly. It hasn’t changed much in the last few years.

I also adjust for Survivor Benefit Plan (SBP) premiums. Unless something changes, I’m planning to elect for SBP coverage.

Minding the Gap in the Beginning of Retirement

Also, I anticipate at least two or three months between my last paycheck on active duty and my first retired pay deposit. There’s no way around this. It will take some time for everything to get processed.

I’ve heard to expect a minimum of a two-month gap and prepare for closer to five or six months even. We’ll use our transition fund to help bridge this gap – more on that later.

Estimating Cost of Living in Retirement

Estimating our living expenses is the biggest wildcard for us right now. That and what type of job my wife is able to find and whether I’ll get any VA disability compensation. So, yeah, there’s a bit of uncertainty, but that’s not keeping us from making best guesses and planning.

Our hope was for my retired pay to cover our “HUG” expenses: Housing, Utilities, and Groceries. We’ve been looking at areas where we’ve lived, where we currently live, and even overseas as options.

Home is Where the Army Sends Us Our Hearts Are

We’ve zeroed in on moving back to the Kansas City area. We really loved it there, we have family and friends close, and our son was born there. It’s the most “home” we have anymore. It’s pretty much the only place we’ve kept connections to as we’ve moved all over the place.

I wish I felt more connected to where we grew up, but it’s become just a place of origin and nostalgia. As much as we’d like to be close to all our family, We can’t really imagine building a life there.

So, we’ve set our hearts on Kansas City. However, with the rising cost of housing, we’ll be lucky if my retired pay covers a mortgage there—let alone utilities and groceries. This means we’ll need other streams of income.

Building Diverse Streams of Income

As we prepare to transition out, we’ve been thinking through what income will remain. The loss of a significant portion of my income from the military is going to sting a bit. However, I feel pretty confident we’ll be okay.

Building My Business Now

One of the best things we’ve done is prioritize building my business. Most people don’t know I run a paraplanning and content writing business outside Enlisted Money. Over the years, I’ve slowly built my confidence and earning abilities. In theory, I’ll be able to simply “dial-up” the work I’m doing on the side and replace a lot of lost income.

I’ve also got some other business plans and ideas in the works. So, hopefully, my income from my entrepreneurial adventures will only increase. Only time will tell.

My Wife Reenters the Workforce – Again

With me being able to take on the stay-at-home/work-from-home dad role, my wife will be able to pursue her career again. We ended up deciding for her to quit because she was barely making enough to cover childcare. My wife is awesome, but being a housewife isn’t her favorite job.

She’s been keeping up with her certifications, and we’re actually looking for her to add one more based on job listings she’s been seeing. I’m very happy for her to be able to seek employment without all the limitations of having to work around my (the Army’s) schedule. Her income will be another stream of cash to rely on.

Short-Term Savings and Transition Fund

One thing we’ve done, which I wish I’d done years ago, is start a specific transition fund. I’ve been stashing a little bit each month into a taxable brokerage account for the last couple of years. Originally, I was planning to have about six months of expenses or at least a couple of paychecks worth in there.

However, I think we’ll probably fall a little short of having the full six months of expenses in that account. The transition fund isn’t our only savings though. We’ve got several high-yield savings accounts and our emergency fund. We’ll probably have about 8-12 months of expenses in cash.

Delaying Large Purchases Until After Retirement

We’re also delaying as many major purchases as we can until I retire. For instance, we’re purposely delaying buying me a truck until after I retire so we’ll have even more money as a buffer. Don’t tell my wife, but my secret plan is to nail the financial off-ramp so we have some “extra” money for me to get a little nicer truck. The plan is coming together nicely!

Moving Early to Start the Job Hunt

The last big piece of the retirement off-ramp is getting ourselves moved to Kansas City while I’m still on active duty. The hope is that we’ll be able to get a house and give my wife enough time to find a job before I get my last active-duty paycheck.

This is going to take some planning and coordination. Worst-case scenario: I’ll have to live by myself for a few months to wrap things up. Best-case scenario: We’ll all be moving about six months before I officially retire.

If all goes well, my wife will be in a job she likes and earning some income well before we need it. We’d love to be able to stuff a few months of cash from her checks into our transition fund on top of what we already have.

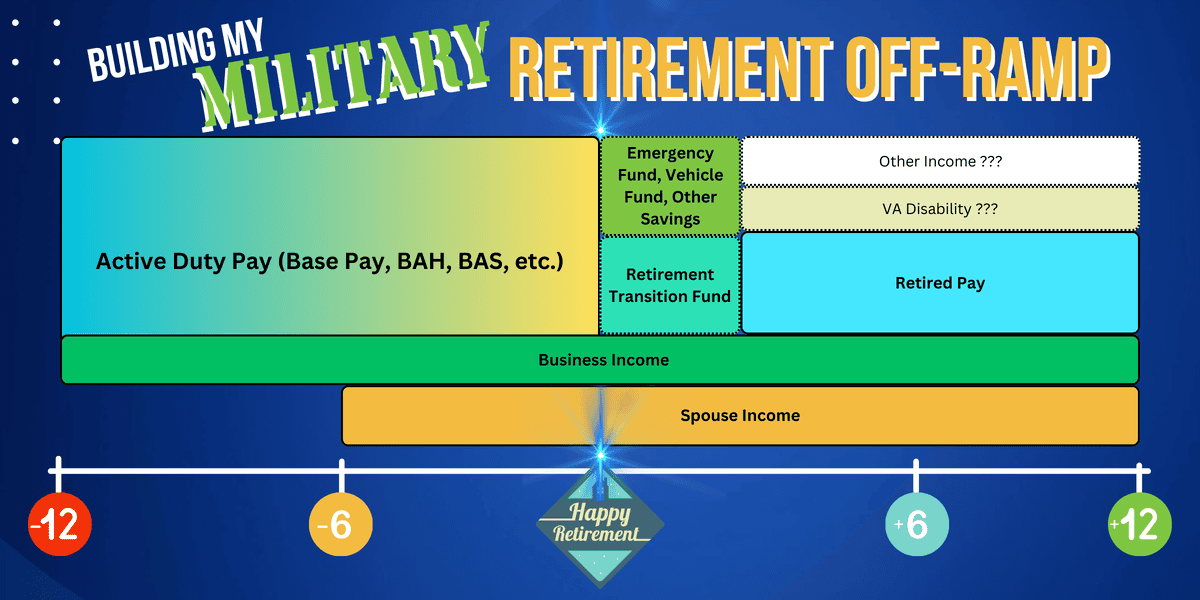

Visualizing Our Retirement Transition and Streams of Income

Contrary to the thousand words preceding this sentence, I’m a very visual person. So, I drew out all our current and projected income streams and savings. Here’s roughly what that looks like to me.

As you can see, we might have a little increase in income right before I retire. Even better, our cost of living should be significantly lower once we leave the East Coast. To top it off, we should also get all of our security deposit back from where we’re renting.

Saving on the Move

In theory, we’ll be staying with family or friends while on leave and looking for a house, so we might have a month or so with minimal housing costs. I know there will be some moving expenses, so we’ll need to plan for that. There’s no dislocation allowance (DLA) for retirees, so that stinks.

However, we own a small trailer to haul my motorcycle and some other heavier things back to do a partial personally procured move (PPM)—formerly and colloquially known as a Do-It-Yourself (DITY) move. This will help us get reimbursement for some of our costs and give us a buffer against going over our weight limit. I have a lot of tools, so weight limits are definitely a concern.

Bringing it All Together in Retirement

In theory, we’ll have a great combination of existing income streams and cash to nail the transition into retirement. I also feel like we haven’t even exhausted all our potential options and resources. You might have noticed that I’m not counting on VA disability or getting another job. I don’t plan on taking on another W-2 job unless it’s something I REALLY want to do or learn.

With everything we have now, we should be able to replace my current income and be in a much lower cost-of-living area. We’ll have family and friends close, so we’ll actually have support available if needed. I think we’re going to be just fine.

Nice plan. Those first few months were a bit tough for us, but having that cushion should help. Congratulations on the transition! Maybe you could make some You Tube tutorials as you go through the process? Even how to get the motorcycle across country and filling out the paper for DYI. I could see lots of people following!

JanBow, I appreciate it! I’ll definitely be documenting a lot of this. I’ll try my best to get some more YouTube videos together. That’s not my strength, but I’m trying to learn how to make better videos because lots of people find those valuable.